The Reckoning Begins: Golden Dome, Deep State Fallout, and the Tariff War

Decentralized Media - America First Dispatch

💰 Economic Developments

Trump’s Tariff Proposal and Market Reactions

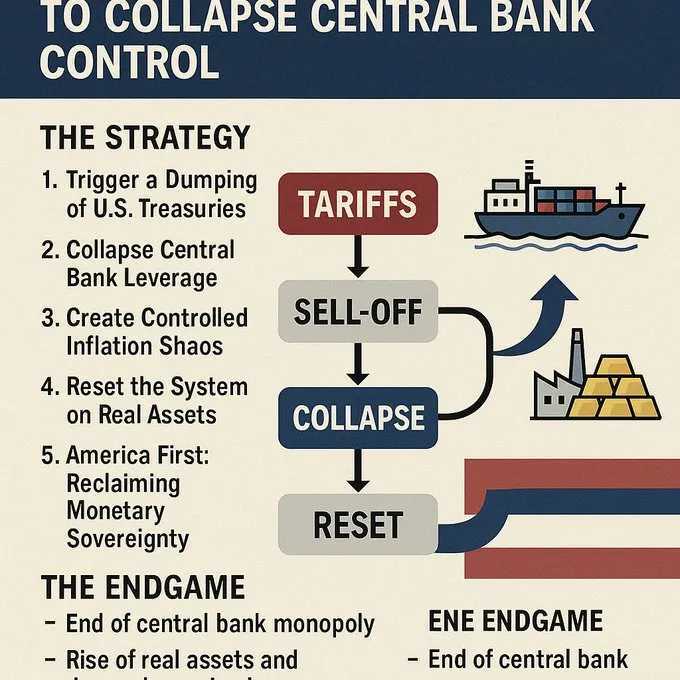

President Trump proposed replacing federal income taxes, which generate $3 trillion annually, with tariffs. For a $100,000 income, this could increase take-home pay by $13,614. However, the Tax Foundation estimates households will face $2,100 more in costs in 2025 due to higher import prices. Vehicles could rise by $5,000–$20,000, and essentials like food, clothing, and electronics may see significant increases. Constitutional challenges exist, as Congress controls taxation. Trump also raised tariffs on Chinese imports to 145%, prompting China to impose 125% tariffs on U.S. goods, effective April 12. Markets reacted sharply: the S&P 500 fell 6.1%, its worst drop since 2020, nearing circuit-breaker levels. Dow futures dropped 200 points, and European markets declined (FTSE 100 -0.47%, DAX -1.53%). Oil prices fell 3.7%, nearing $60 a barrel, with the Energy Information Administration citing Trump’s trade policies as a factor.

► Sources: https://finance.yahoo.com | https://reuters.com | https://nytimes.com | https://bloomberg.com

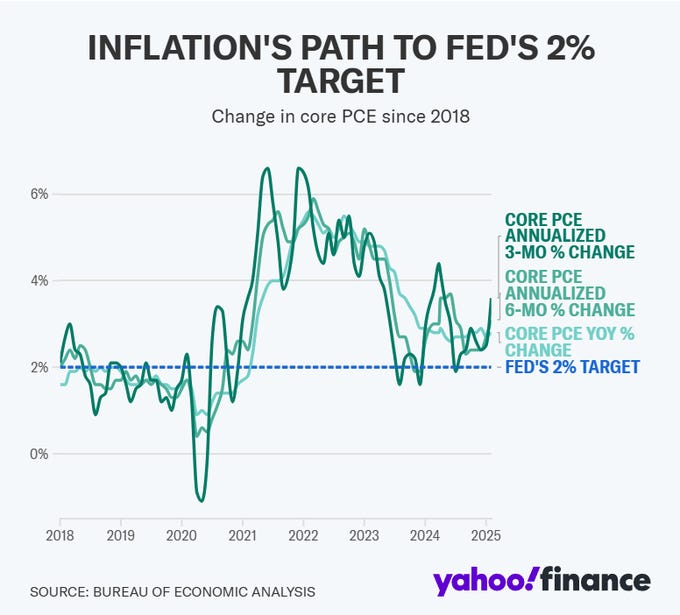

Inflation Declines, Tariff Risks Loom

March CPI data showed inflation at 2.4% year-over-year, with core prices rising 0.1% month-over-month—the slowest since 2021. Lower gas and used car prices contributed. However, Trump’s 145% tariffs on China and 10% universal duties could drive inflation higher, with estimates suggesting 4% by year-end. The EU paused retaliatory tariffs for 90 days, but U.S.-China trade tensions escalated, causing market volatility. The S&P 500 briefly rallied on the EU pause before falling when China reciprocated with tariffs.

► Sources: https://finance.yahoo.com | https://nytimes.com | https://reuters.com

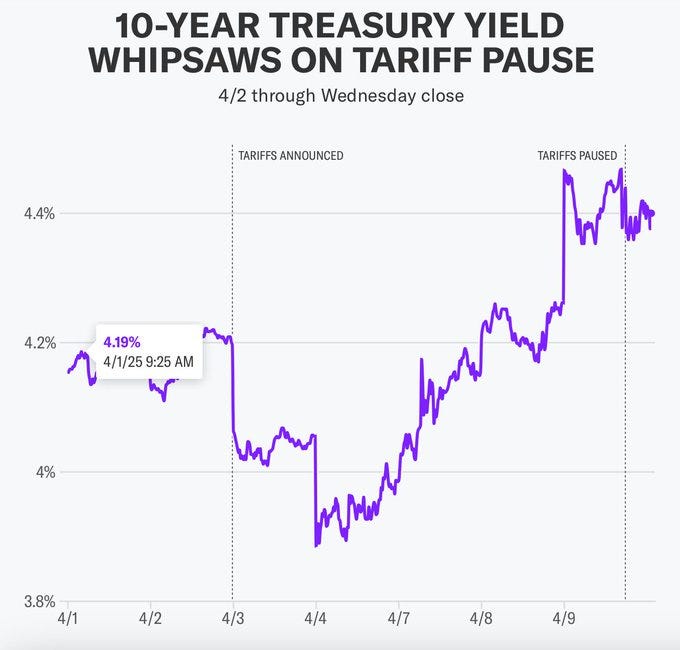

Treasury Yields Surge, DOGE Uncovers Fraud

U.S. 10-year Treasury yields rose to 4.40%, up 53 basis points since Monday—the largest three-day increase since 2001—driven by tariff uncertainty. Concerns exist that China may reduce U.S. debt purchases, potentially raising rates further. The Department of Government Efficiency (DOGE) reported $382 million in fraudulent unemployment payments, including claims from individuals over 115 years old and others not born until 2154. The Treasury Department is cutting offices, including IRS positions, and outsourcing bond servicing.

► Sources: https://finance.yahoo.com | https://nypost.com | https://govexec.com

🗳️ Political Updates

GOP Spending Cuts and SAVE Act Passage